VC Subsights

Update: read my reflections on my year of subsights here: Vanitas, Subpar Ideas, & Some Reflections Thereupon

I've been capturing some thoughts about VC since March 23, 2023 and plan to continue for a year. I’ve been posting these daily on X with a LinkedIn follow-up, but if for some reason you want the whole thing, here it is.

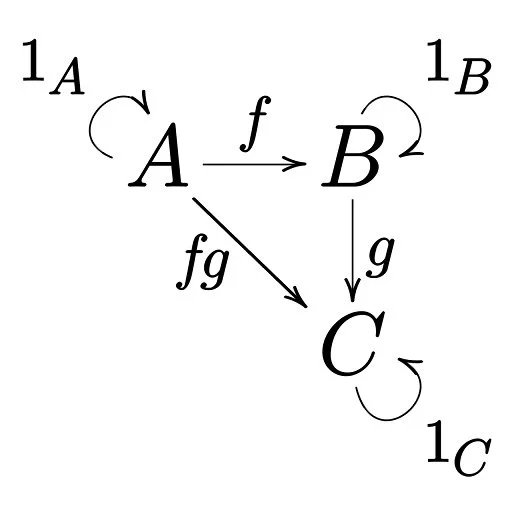

But first…what is a “subsight”? 🧐

It’s a thought that doesn’t quite rise to level of "insight"...so I’ve demoted it to the category of a “sub” sight.

1/365: if a founder has a brokerage in their bookmark bar it's a red flag. First thing I look at when the demo starts.

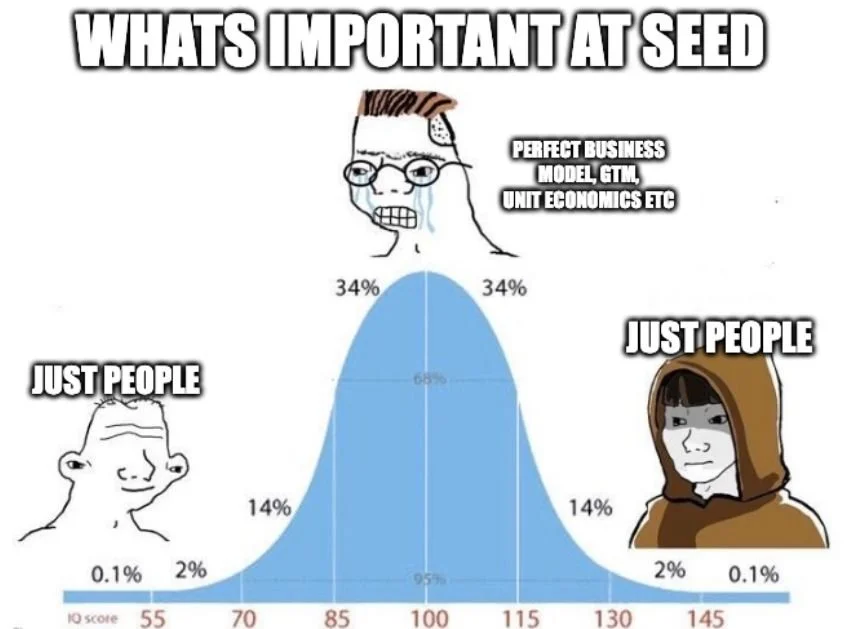

2/365: I'm running on a cyclical nature with this one, back to the median in a few years I imagine.

3/365: a clean downround is always better than a complicated upround.

4/365: don't ignore the signals from the first board meeting.

5/365: a strong founder signal is coming away more excited each time you chat with them. BUT chemistry alone doesn't predict exit outcomes.

6/365: Delaware incorporation is great because the Chancery court judges are super competent and are working on 231 years of case law.

7/365: today's founders are tomorrow's LPs (or GPs). Today's institutional investors are tomorrow's institutional investors.

8/365: get off the board before the S-1 if you want to easily sell at lockup expiration.

9/365: better to ask a bunch of dumb questions if that's what you need to actually understand the business rather than trying to sound smart.

10/365: biotech is hard.

11/365: founders pour their hearts and souls into their companies, it's polite to show up to intro meetings prepared.

12/365: the goal of the first meeting is to have a founder so relaxed that they can shine and show their best work. Easy to be a toughy, hard to quickly put someone at ease.

13/365: build velocity is enormously important, but it must be coupled with focus.

14/365: when fundraising it's nice to keep a disciplined timeline; however, in the absence of external forcing factors, hard to get VCs to follow it.

15/365: recaps don't usually work. But if it does, and you don't participate, the pain is "participating preferred" level.

16/365: founders - ask a prospective VC about the last portco they didn't reup in as a reference check (if you want to be tough ).

17/365: a common reason for founders breaking up is a mismatch in work habits and expectations.

18/365: never ignore breakout success that's validated with numbers.

19/365: the value of a good board member is highly underrated on Twitter. Working with someone like @duncandavi is eye-opening.

20/365: Augustine's laws are so good that I'm considering pairing these subsights with his real insights.

"Software is like entropy. It is difficult to grasp, weighs nothing, and obeys the Second Law of Thermodynamics; i.e., it always increases."…

21/365: this type of S-1 is ok. Let's do more of these.

22/365: [only tangentially VC related] how rare to be able to give, unalloyed, to someone. How meaningful to receive, unalloyed, in need. Tangentially related: startup founders are some of the most generous and compassionate people.

23/365: if you have to RIF, shoot for once.

24/365: you’ll learn how well your feedback actually is received when you’re out of market.

25/365: a well timed joke can cut the tension and be a huge boon in a negotiation.

26/365: the do:say ratio should be at least 1:1.

27/365: the main founder phases: super-IC, super-hirer, super-manager. Very rare to be good at each.

28/365: a lower valuation is better than participating preferred.

29/365: businesses with long cash conversion cycles require greater warchests than a normal SaaS company.

30/365: move heaven and earth for your Fund 1 LPs.

31/365: in operations, substance before polish. In pitches, the opposite.

32/365: be wary of VCs turned founders, and founders turned VCs for the first three years. After that they'll know if the new role is right.

33/365: the pitch needs to be easy enough to understand super fast, but nuanced enough to make the listener feel smart and that they've derived a unique insight from it.

34/365: if you can't code, the top priority is finding a technical co-founder. Don't kid yourself otherwise. The road is littered with good ideas left to wilt for want of devs.

35/365: if your friend starts something new, go "mom mode" on their socials. Like or retweet everything about their new co. It takes 1 second. Why be precious with your praise? (I was guilty of not doing this for a long time! Mistake.)

36/365: hire a UXR consultant for a few sessions before a business coach. Much can be solved by getting this right.

37/365: the old rule of thumb was - if you're moving more than 10% of the volume in a day, you're doing it wrong. Spread it out or do a block.

38/365: keep a list of the companies you passed on that raised great rounds, but wait to dive too deep into the error until they’re sold/IPO. The story of success (for the VC) is not finished until there’s liquidity.

39/365: don’t start with a LLC if you’re planning to raise VC dollars.

40/365: there are a lot of badass engineers with <300 connections on LinkedIn. Followers/connections aren't always the signal...

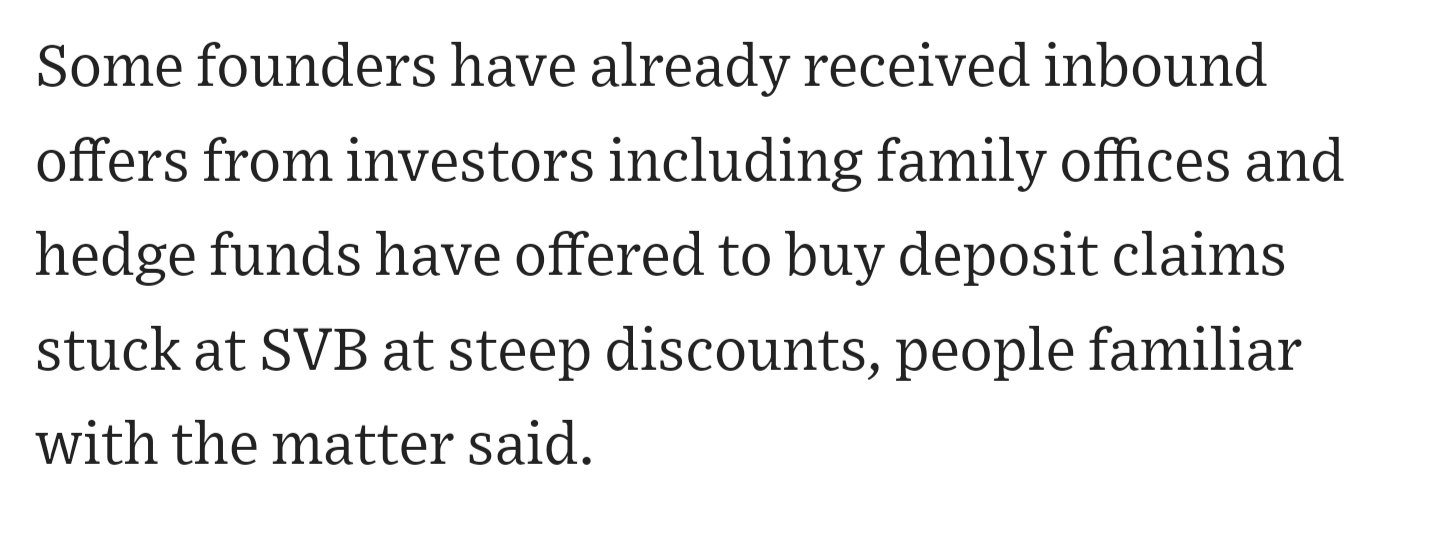

41/365: March 12th gleanings (leaving out the VC advice) in the WSJ vs. Buffett's take on April 12th. (False) necessity never made a good bargain.

42/365: if you are expecting back-pay with this round, make sure that it's super clear in your use of funds. (To be fair - I haven't seen this in 8 years, and then only rarely in weird situations)

43/365: is being a founder a core part of your identity? If so, the vicissitudes of your current startup won't change that. It is an immutable, irrefutable, part of you. Clear perspective is easier to gain when you see it this way.

44/365: if you are hiring a friend they should be 1.5x better than all other candidates you evaluated for the position. Establish this as a working relationship at the outset. Otherwise, you're liable to lose a friend and harm the biz.

45/365: never a downside to sharing clear metrics with investors. Many downsides to trying to report manufactured metrics.

46/365: it is a sin to sell out too early. It is a sin to leave 25x or 50x on the table if it ultimately ends up as a bust.

47/365: let's do a few weeks of Sprint stuff (after all we think about it all the time @CharacterVC) So many things in the startup world are viewed as alchemy when they are closer to science. Sprint = 5 days to clarity.

48/365: with AI stuff replacing B2B SaaS stuff minutes spent on legacy applications is a liability, not a sign of customer love.

49/365: in a Sprint we work together, alone. It’s amazing to see how ideas flow from team members that usually are quiet in meetings.

50/365: why is a Design Sprint so useful for an AI company? Go read @jakek's case study on Phaidra!

51/365: test before you build.

52/365: if you’re hiring a consultant it’s already dire.

53/365: I always "like" unlisted YT demo videos. The thrill of being first is intoxicating.

54/365: @Superhuman has been working on their Android app for at least 5 years. Must be a choice at this point. Quite interesting.

55/365: the Covid-19 pandemic reversed wage inequality by 25% (tracked since 1980). What non-intuitive second-order effects are most impactful today?

56/365: the first skill to develop as a new analyst/associate is how to ask the right questions. Best to shadow the most skilled MD/GP at your firm and debrief with them after about why they asked what they did.

57/365: the second skill to develop as a new analyst/associate is how to listen deeply. Focus.

58/365: don't be scared to take losses, be scared of continuing to fund losses.

59/365: at least two offers when being acquired.

60/365: don't totally discount the competition in the deck unless you're winning 9/10 deals. If that's the case there's probably not a deck needed.

61/365: you don't need to sound smart at the board meeting, you need to make sure dumb things aren't happening.

62/365: the co-investor that always thinks you are right is not a good co-investor.

63/365: a founder told me today that many AI companies are "building lightsabers to cut chicken." Love that phrasing!

64/365: minimize dilution, but maximize chances for success with each round. Price fairly, but not so high that you have to achieve perfection.

65/365: don’t become a bank for your customers.

66/365: good question to ask VCs "when and what was your last investment, and how did you get the conviction to make it?"

67/365: another q worth asking “who is on your investment committee and who votes on new investments?”

68/365: getting above 20% net profit margin consistently is a feat. Being in SaaS alone doesn't buy this.

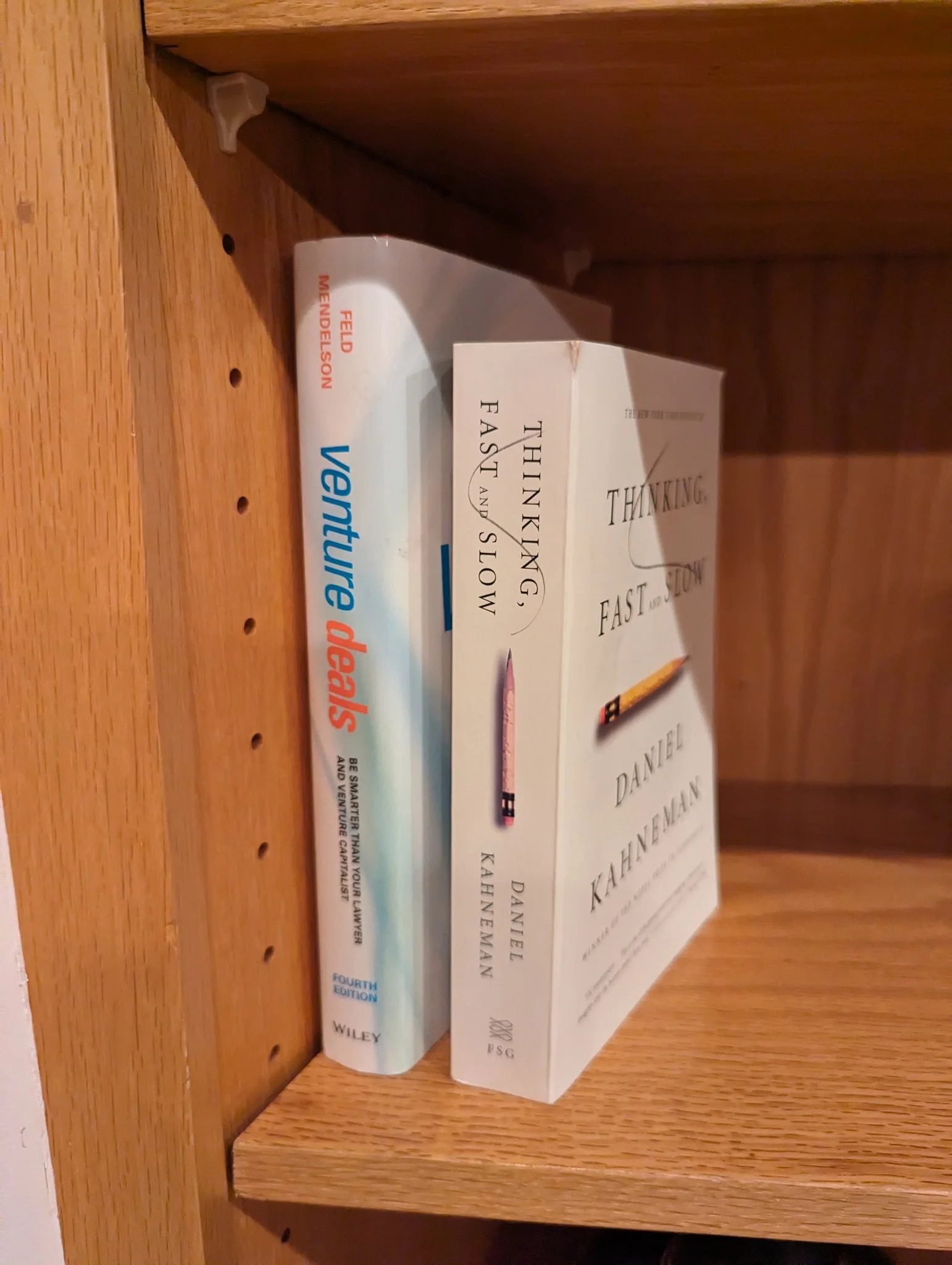

69/365: I've always (unintentionally) worked with people who have written books. Lucky situation in hindsight, would recommend.

70/365: @NotionHQ has accomplished so much with so little. Impressive case study.

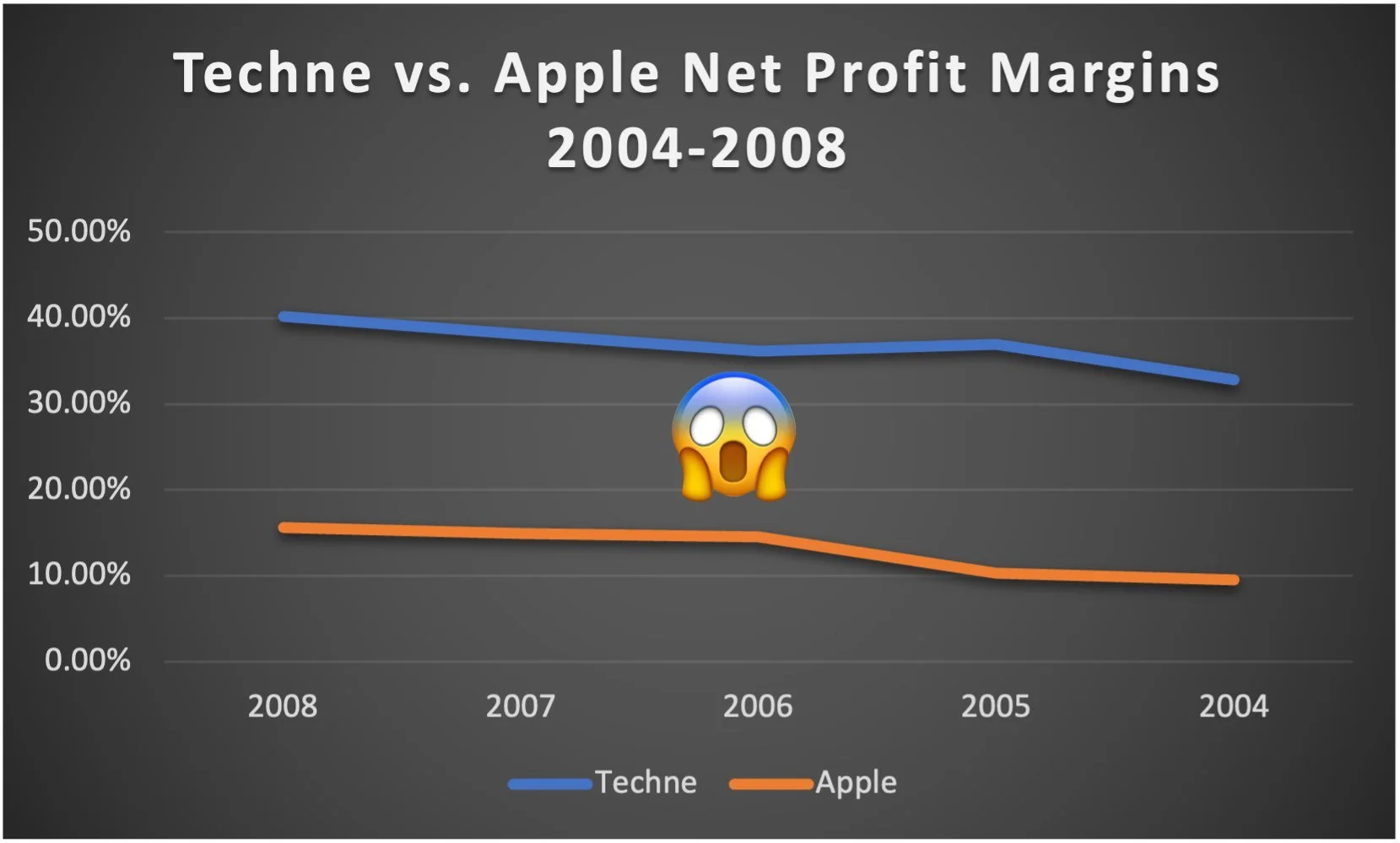

71/365: we often hear about "selling picks and shovels in a gold rush" but it's hard to understand just how different those businesses can be if done right. Here's a chart of $TECH puking net income vs. $AAPL from 2004-2008.

72/365: sometimes startups are given much more leeway before they put up numbers. Then the clock starts ticking and investors are more skeptical!

73/365: civil society requires human explainability for decision making which will preclude the widespread utilization of AI in this sphere until a consensus framework is adopted that gives adequate confidence in the models framework. Individuals and organizations will not face similar constraints which could produce an interesting imbalance in reasoning and approach.

74/365: for organizations the concept of an agent that suggests the best actions for the entire business is a likely outcome in the next 5-10 years. Humans at first will make the final call, but over time more autonomy will be ceded.

75/365: the Enlightenment is now over. Rational discovery solely by humans is ceded to an algorithmic-people partnership. We are in the Automatic Age.

76/365: it's slightly counterintuitive, but when looking at AI companies the people (who are working on things that may augment or replace people), are so important.

77/365: perfect human alignment on AI development is an insurmountable problem because individuals, corporations, and governments have different values they wish to optimize.

78/365: still on the Accelerate AI Development bandwagon: Accelerate AI Development: An Open Letter

79/365: living to fight another day is as important as the perfect upround at times.

80/365: language as a barrier to communication is rapidly declining.

81/365: "The trick, William Potter, is not minding that it hurts."

82/365: it's the compelling weird success stories that stick in your mind. The ones you know were good, but had to be rejected for not being "on thesis" for some reason.

83/365: I enjoy reading the million newsletters I receive from founders 🤷♂️

84/365: don't underestimate the potential for a miscommunication. Move swiftly to bring back clarity, and don't hold grudges for honest mistakes.

85/365: your word is your bond, bond to the word with every action.

86/365: if you would have your business done, go; if not, send.

87/365: for some, five times easier to give a critique than receive one. For others the opposite.

87/365: 808s & Heartbreak was not universally acclaimed or West’s highest selling album, but it set the stage for so much over the past 15 years. [yes I messed up the numbering some how…so lucky number 87 gets two]

88/365: when we raised our first fund @CharacterVC we found that LPs that were skeptical at the outset almost never converted.

89/365: every time I meet a founder I come away energized. Amazing to see all the cool things people are working on.

90/365: a major question in AI investing right now is akin to where you should have shorted horses vs. invested in auto companies. Context, Warren Buffett:

If at the start of the 20th century you had seen what the auto was going to do to this country, the impact it would have on the lives of then your children and grandchildren and so on. It just, it transformed the American landscape.

But of those 2000 companies, three basically survive. And they haven’t done that well, many times.

So how do you pick three winners out of 2000? I mean it’s not so easy to do. It’s easy when you look back, but it’s not so easy looking forward.

So you could have been dead right on the fact that the auto industry, in fact, you probably couldn’t have predicted how big of an impact it would have. But you wouldn’t have, if you’d bought companies across the board you wouldn’t have made any money…

I’ve always said the easier thing to do is figure out who loses. And what you really should have done in 1905 or so, when you saw what was going to happen with the auto is you should have gone short horses.

There were 20 million horses in 1900 and there’s about 4 million horses now. So it’s easy to figure out the losers, you know the loser is the horse. But the winner was the auto overall.

[I’ve always thought if I wrote a book I’d call it “You Should Have Been Shorting Horses”]

91/365: “I wanted to write that my work consists of two parts: of the one which is here, and of everything which I have not written. And precisely this second part is the important one.”

92/365: bowling is the lazy gentleman's sport.

A supremely underrated activity.

It is perfect because no one cares if you are good and no one cares if you are terrible.

Had the chance to throw some sweet frames at Presidio Bowl earlier this week with a friend.

93/365: someday you may have to be the brave little toaster. No one else will be able to do it. Commit and do the right thing.

94/365: better late than never.

95/365: automated email outreach has dropped true cold inbound to almost zero.

96/365: in a startup newsletter today a founder laid out, in four clear points, why their company is not working:

1. Raise issues

2. Built the wrong product feature

3. GTM channel was not understood well enough

4. Distribution problems

Rare to see such honest clarity.

97/365: first principles thinking will lose more and more relevance over the coming decade. Consider the failure of first principles research to yield accurate structural predictions of proteins, while deep learning deftly derived it.

98/365: it's best when values are aligned across LPs, GPs, and portfolio companies. Too many divergences encourage unnatural things.

99/365: the best pitches are like earworms, you find yourself inadvertently thinking about them after.

100/365: I will gladly talk about the weather for 6 minutes on an intro call.

101/365: GMV is not ARR. (I know that’s a basic one, but have seen the mental gymnastics related to valuation justification for some of these companies.)

102/365: “what do we need for series A?” Good evidence of PMF and how to scale.

103/365: fund admin should be easy, we use @cartainc. Highly recommended.

104/365a: "Men seek retreats for themselves, houses in the country, sea-shores, and mountains; and thou too art wont to desire such things very much."

104/365b: "But this is altogether a mark of the most common sort of men, for it is in thy power whenever thou shalt choose to retire into thyself."

105/365: routine dictates so much of our productivity, or non productivity. Disruptions should be treated as an opportunity to improve. Never let a crisis (or change) go to waste.

106/365: no pain, no joy, know pain, know joy.

107/365: good intentions work out most of the time, but when they don't, it's often a result of not making the harder decision at the outset.

108/365: therein lies the rub: we are not investing in authors, but in doers. Writing and Creating

109/365: read the board materials before the board meeting.

110/365: my favorite German companies are @AldiUSA and @MYKITAofficial. Different in almost every way, but both excellent.

111/365: after a super long Friday it's ok to rest on Saturday.

111/365: ok UK startups 🇬🇧. [yes another double, 😮💨]

112/365: what's your best repeatable routine for a great Sunday?

113/365: 15 years on LinkedIn...filed under moderately early (around when Sequoia invested) boringish adopter status.

114/365: first the problems then the fun.

115/365: have a serious sit-down with your partner before starting something new (ideally informed by some perspectives from founders who have done it before and their partners.) Very long and hard journey, need family buy-in.

116/365: impossible to overstate how important it is to have exceptional co-founders. I wake up every day so excited and grateful to work with @jazer and @jakek. Support, push, grow, build 🙌

117/365: the desire for luxury, not utility, built much of civilization.

118/365: mornings are most productive.

119/365: how are religion and social media similar? Shared constructs of reality for masses of people.

120/365: the best stretch of weather in less-favored climates would be considered mediocre, or poor, in other locales. The same is true for companies - the best run of actions for some are comparable to the mediocre stretches of the great ones.

121/365: many startups fail after doing all the right things. But it's also surprising to see how many fail because they missed basic stuff that was not obvious at the outset (but is super clear in retrospect.)

122/365: I try to never be late to founder meetings, but to the few founders I've been late to: sorry again 🙏 Cumulatively I think I'm at +35 minutes since starting Character. If only I could reverse this somehow 😩

123/365: this product is completely free. Obviously an issue if not working as intended, but even if it only saved 1 life seems like a huge win? Google alert failed to warn people of Turkey earthquake

124/365: ahead one hype cycle when raising can mean a ton of nos from investors, but the worst thing is you don't get a do over most of the time.

125/365: rereading the ever excellent Indistractable by @nireyal. “Most people don’t want to acknowledge the uncomfortable truth that distraction is always an unhealthy escape from reality.” How true.

126/365: ayant connu le chagrin tout au long de ces interminables journées d'hiver, la lumière du soleil sublimait désormais chaque cellule de ma peau parmi les flots turquoises, devenant à jamais, inconvenante, un feu follet parmi le ciel d'un bleu immaculé.

127/365: it's ok to take a second (or third) look at something you passed on, but if you pass again you better have done a lot of work and the reason should be really good. Don't be a deal tourist.

128/365: it's a hard thing to do, to wind down with grace.

129/365: it's not done until the money is in the bank.

130/365: don't forget to sleep.

131/365: what's your best post travel strategy? Unpack immediately? Ignore and relax?

132/365: I have the best neighbor in the world. Easily 2xs the living experience. I wonder what the analog is in startups?

133/365: fundamentally you build something, you don't build money. "I found that essence rare, it's what I looked for I knew I'd get what I asked for"

134/365: a tier-1 coinvestor is not DPI.

135/365: favorite day of the week for getting work done? I love Mondays.

136/365: there are two types of super-smart founders that I've seen, and they are on the opposite ends of the spectrum:

Option 1 - eternal optimist, makes you feel great about every question you ask because they genuinely see it in the best light

Option 2 - hard-nosed skeptic, makes you question if you thought closely enough about their startup. Probes deeply and gives you the most realistic answer possible

Both are great! Haven't seen many super successful founders fall in the middle of this spectrum.

137/365: talked to a founder today who had a nice exit. One of his big takeaways was to build deep and broad relationships with partners, they can sometimes turn into acquirers, but can take years.

138/365: @nedwin is great at this though. That's it, that's the subsight. See here

139/365: Rudin's Principles of Mathematical Analysis is a favorite.

140/365: exclude year 4 and 5 from your projections in most cases.

141/365: "better a third pivot than a second wind-down" -- founder told me this today. Completely agree when it's a great team!

142/365: Nothing like a busy annual meeting day to pump up the jams.

143/365: "Bring tea for the Tillerman, Steak for the sun"

144/365: when you see an interesting presentation go talk to the speaker after.

145/365: cool to see second-time founders in action. Some have gigantic changes in how they work, some don't. Can be better to not have too much luck in the first company (but hard to know).

146/365: the goal in 2021 was to throw cash into the furnace as fast as possible and then tell everyone how bright it's burning.

147/365: you can always send an angry email tomorrow.

148/365: if you do the hard thing at the start of the day, the rest of the day is always easier.

149/365: acquire mostly in stock if you are way overvalued. Cash if you are undervalued.

150/365: it's important, though painful, to fire as fast as possible when the decision becomes clear. You're not just making the decision for one person, but potentially the whole team. Keeping the wrong person can scramble the whole thing.

151/365: you don't get extra credit for unnecessary pain. If there are simple things you can automate or outsource away, do it. A founder's time is super precious.

152/365:

153/365: congratulations again to @isro on the recent success with Chandrayaan-3!! Love working with Indian 🇮🇳 founders for all the reasons that have made ISRO fly.

154/365: everything's relative at your relatives house.

155/365: I have 3 gut check questions I like to ask myself before I invest in any founder. From weighty to not:

A) would I trust this founder to execute my estate?

156/365: I have 3 gut check questions I like to ask myself before I invest in any founder. From weighty to not:

B) would I want to work for this founder?

157/365: I have 3 gut check questions I like to ask myself before I invest in any founder. From weighty to not:

C) would I want to work with this founder as a co-worker?

Those are my 3 quick gut checks!

158/365: in the right abstract lens all startup growth cycles are like a fractal - zoom in, zoom out, the pattern is the same.

159/365: "Keep your eyes wide open before marriage, half shut afterwards."

160/365: the opinion of wealth makes some men poor.

161/365: long weekends are bonus time for thought on long term work projects.

162/365: know the volume discounts for your BOM and then double it and add several months. ~Sub 1,000 HW products that don't make it are painful learning lessons.

163/365: once a founder, always a founder. If you start something new, regardless of how it works out, that is a huge accomplishment - most people never chase their dreams. Rest easy after your years have passed that you gave it a go 🫡

164/365: investors seem to be putting a premium on time to revenue from inception these days.

165/365: What All Founders Should Know after @ycombinator Demo Day S23

166/365: Founder Special - My Top Eleven Companies from Demo Day S23

167/365: inevitably you'll hire B players. The right type of B players are actually great because if paired with an A+ employee they can float up to being a great. But important not to pair them with As that are only individual contributor super stars.

168/365: irrational hype and grifters are not actually bad in the long term; investing imprudently is. I mean that as a customer and investor.

169/365: a nascent driver of inequity in the next 20 years will be the age and sophistication of personalized AI agents. Imagine a child who has an incredibly data-rich and powerful algorithm personalized for them based on their family's collective work, education, and recreational experiences over the years...Compared with a child who does not have the data rich or experiential advantages from their family. The advantages to the former are compounding in nature.

170/365: being a contrarian doesn't matter if you're wrong most of the time. Hewing to the grain and against it can be less important than deep insight (which then may influence the position.)

171/365: any given day a majority of your VCs are going to be lazy or dumb. (Example: today I was dumb.) Figure out which category it is today and adjust.

172/365: a true expert in a space is the difference between one person with mastery learned in months versus teams in years. If they're both startups, the former usually makes it.

173/365: praise little, dispraise less.

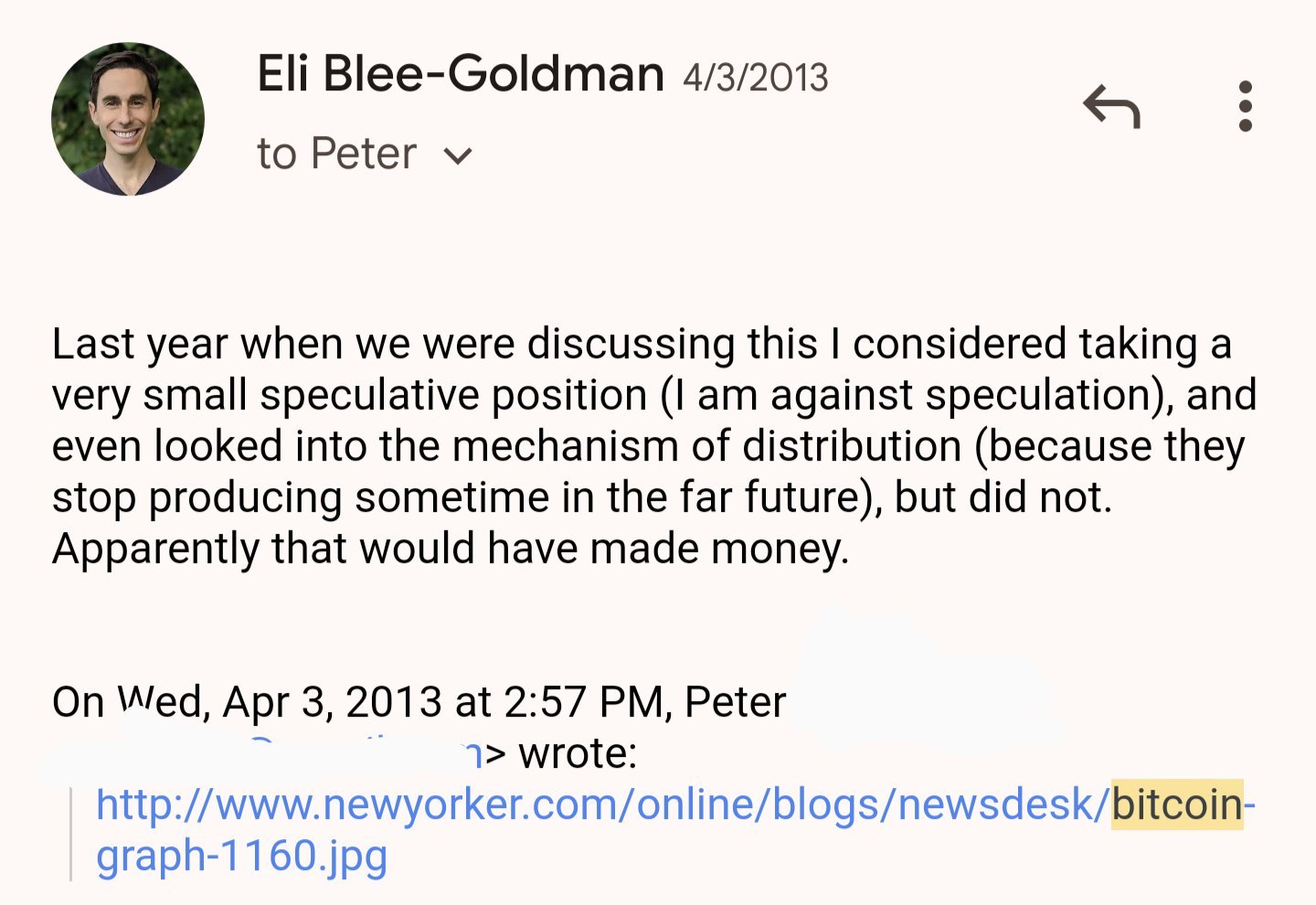

173/365: "he who angers you controls you." Saw this on an anti-road rage sign in Wisconsin and thought it was genius. [another double date post? Were my eyes broken?]

174/365: An Ethical Approach to Emergent Sentience in AI Systems

175/365: the syndicate can't save you, not really.

176/365: if something big messes up collecting cash from a customer your job is how to fix the situation for the crew you're selling to. The world is out of your control, but the customer experience (even post sale) is in your control. Related

177/365: "a fox knows many things, but a hedgehog knows one big thing"

178/365: sometimes, like Napoleon (the one you haven’t heard of) you declare yourself “Konijn van 'Olland.”

179/365: inertia in startups is like a ball in the bearing, it rotates but that doesn't necessarily mean you're going anywhere.

180/365: sometimes you won't be able to change the outcome, but even if it's not rational, it's right to try.

181/365: don't mistake PMF for a good business. Airliners are only doing ok 114 years after the first airline was founded as glorified credit card lead gen sources.

182/365: the further you get from starting or funding companies the weirder it gets - the drop off in incentives and skills is exponential. The basic skill test is this: could you be hired one step ahead in the chain? I.e. VC->startup founder, service provider->VC

183/365: so many suboptimal outcomes from social contagions. Conversely, so much to gain from alignment with excellence. I think this is a huge part of the value of @ycombinator - the community is aligned on a set of norms of startup excellence.

184/365: always act in good faith.

185/365: he who resolves to sin once more, resolves to sin again.

186/365: short sellers are good.

187/365: Satoshi is either Hal Finney (80%) or a governmental agency (20%). No living man creates a philosopher's stone only to watch his gold grow, but never touch it. And tragically it couldn't save the good man that Hal was. 🙏 thanks for reading my bitcoin post. [might be wrong about the Hal thing…but Satoshi is dead.]

188/365: if you show me it's working I'll change my mind.

189/365: we all know VC fund returns are unevenly distributed (skewed towards a few making the lion's share), but I surmise a similar dynamic exists in family offices. Two of the many I've chatted with are so clearly super-stars.

190/365: a ton of small nos can feel bad, but it's the big yeses that are more meaningful.

191/365: what's past is prologue.

192/365: Athena tells us in Eumenides"You wish to be called righteous rather than act right."

193/365: rarely (1/10,000?) I meet someone who is "right" about something far more consistently than their peers (whether in startups, art, world affairs, etc.) These people are often fanatical about their interests, but not always well credentialed. Fascinating.

194/365: related to yesterday - you see so much on Twitter about the "perfect routine", ice baths etc. Just focus on being truly amazing at the thing you're working on AND working with people that are. The unlock is doing the thing, not fine-tuning the edges.

195/365: good writers are amazing.

196/365: when experts say "I don't know" about a question in their domain it's often a signal they're truly skilled.

197/365: there is a stream of kindness that runs through all of us, dip your cup and share without reserve. Whether a trickle or rush, it is a flow that does not end, a cistern of endless depth, an oasis appearing through the storm. Look in yourself, you'll see.

198/365: simpleton procrastination tactic: literally ignore the annoying part, POOF it from your brain! Example:

A) need to pay a bill → it's annoying to log on, blah blah😮💨→do it

B) need to pay a bill → NULL→do it 🧘

For real tips: Make Time

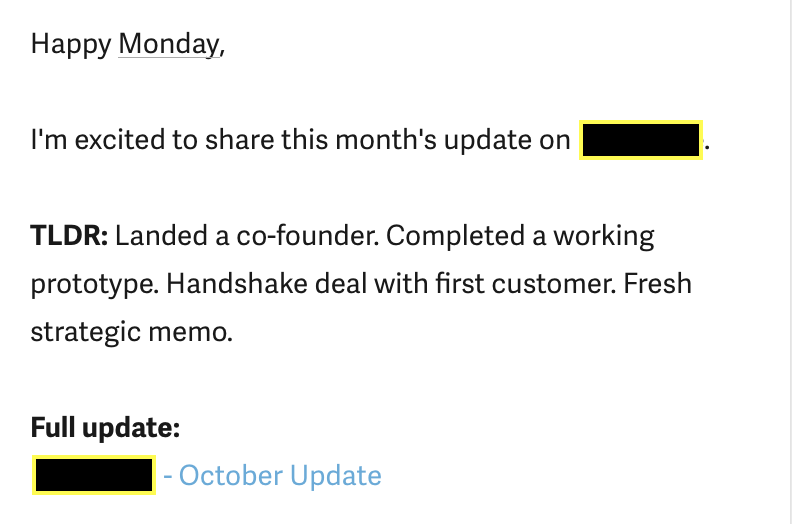

199/365: I get tons of company updates (which I like reading!), but I usually skim for the highpoints given the volume. Yesterday a founder sent me an update that was PERFECT, sharing (with their permission) for others:

200/365: when you have the difficult discussion in a high-trust and open way you greatly improve the eventual outcome. Peel the onions, even if it causes a tear because the soup you make will be better than spilled milk. (I love the low bar for these subsights...) Channeling a bit of Ricky here. IFYKYK

201/365: it is ok to give the same pitch 5 times if it leads to an investment.

202/365: in your competitive matrix you anchor a VC on the battle lines that are important competitively.

Don't miss the chance to decide which topics you want to address.

203/365: it's hard to believe, but the creator is often not the perfector.

204/365: it's easy to miss something important if you don't think a little deeper from time to time. This was a painful one for me (rectified later but still...) #bitcoin

205/365: an exited founder on a panel saw an angel in the audience who scorned him early on. He publicly ripped into her for the next 15 minutes. Livy tells us of Scipio "Venisse diis simillimum iuvenem, vincentem omnia, turn armis, turn benignitate, ac beneficiis"

Or "There came a youth very like the gods, conquering all, both by arms, through kindness, and benevolence" If the man who defeated Carthage is remembered as such, should not your munificence as a founder forget such slights?

206/365: the older the customer, the greater the importance of just giving them a phone call (vs. email, Slack, post, etc.)

207/365: sometimes in business, we must remember that we are working to make "money, money, money, money, money" Put most elegantly by @Alfakat and @Pammie_MissS. https://www.youtube.com/watch?v=HPvOJUWGlLw&t=170s

208/365: replicating an ecosystem (like Silicon Valley) is basically impossible, each must find their own path to success. The end result superficially looks similar, but it's more often the case of history rhyming rather than repeating.

209/365: related to 206 - one of our most successful CEOs jumps on a plane when he wants to make a sale. Amazing how powerful in-person is to close.

210/365: empires have been built on the concept of not having chocolate dissolve in your hands. Food for thought.

211/365: "...I'm no good at being noble, but it doesn't take much to see that the problems of three little people don't amount to a hill of beans in this crazy world."

212/365: in Episode 1 Qui-Gon Jinn tells us "there's always a bigger fish." So it is in business; in the depths behemoths lurk, the pursued can easily become the acquired.

213/365: remember that human language and the corpus used to train LLMs are fundamental limiting factors. (I think? )

214/365: why is @Oobahs The Shed genius? Perception can program experience. We often think that the fundamentals of the product we create will dictate how it's valued. The relationship is not always so one-directional. https://www.vice.com/en/article/i-made-my-shed-the-top-rated-restaurant-on-tripadvisor/

215/365: what is a master mark? Listen here on Burial x Four Tet's "Moth" https://youtu.be/sCzJQRVbWtE?t=102… The beat reverses for a sec. Why is this important? Tiny things can be incredibly important & distinguishing differences between excellence and exceptionality.

216/365: some of the time an "X" factor for a decision is due to lack of clarity on an investing thesis or not wanting to be blunt.

217/365: "under every stone there is a scorpion."

218/365: World of Warcraft cost around $63M to make and has now returned $20B+ in revenue. Filed under durable profit notes.

219/365: wire on the close date. Don't miss the close date.

220/365: people will grind all day in a game for basically nothing. Don't underestimate power and habit to dictate actions.

221/365: I don't like @DocSend. PDFs are better.

222/365: if you're open to the unexpected it often turns out better than you ever expected.

223/365: if you get sick on a trip and there is little prospect of improving, then there's no shame in hustling home to get better, and back to work quicker. Obv. some meetings you can't miss no matter what, but no need to be chowing Pepto all the time to make it.

224/365: don't play games at the close, but make sure everything is correct before signing.

225/365: almost asleep, what to work on next? Do it in the mornings.

226/365: when @Grammarly raised in 2019 @htaneja had a genius comment about their success and competition: "While there are large companies attempting to innovate in this space, creating intuitive AI that complements our natural communication abilities isn’t their primary focus. And that’s why, despite any competition, they’ve [Grammarly] got more than 20 million daily active users.” How spot-on and insightful is that!

227/365: the one nice thing about not being able to fall back asleep in the night is you end up with bonus hours in the day to catch up!

228/365: a Cassandra to survive, but a Pollyanna to win. Always, you should encapsulate both.

229/365: more than half of the game is making sure you're playing the right one rather than optimizing to win something that's no prize.

230/365: it is a silly to derive honor from those long dead. All the same I hope to serve, in time, like a great granduncle of mine. Sea thrashed on the way back to Aran, off to Galway the next day, sick, but off to help the poor. https://libraryireland.com/PennyReadings/OFlahertyAran.php

231/365: "To be once in doubt, Is once to be resolved"

232/365: MY co-founder went viral .

233/265: Whatever GTM you are pitching needs to be working. Excellent point by @jazer

234/265: you can have speed, excellence and conviction in one domain or many, but it doesn't necessarily translate to THE thing you're trying to do now. Many astronauts go into business, but few have been big successes.

235/365: noscitur a socio.

236/365: tomorrow, do it right.

237/365: errare humanum est, perseverare autem diabolicum.

238/365: "Don't be shy, just let your feelings roll on by, Don't wear fear or nobody will know you're there"

239/365: you're beholden to answer your LPs to their satisfaction, but you must make the decisions as a fund manager.

240/365: at times you will lose your powers of oratory and eloquence, but as long as you speak the truth all will be well.

241/365: life will change for your LPs (on the upside and down), it's good to flex and work with them. Fortunes change, but relationships shouldn't.

242/365: one of our LPs was slow to sign something because he was headed to teach 7th grade remedial math and then help someone with an expungement.

243/365: it can be a great benefit to be underestimated.

244/365: second rate expertise is not the best.

245/365: an easy tip for founders - don't make anyone at the VC look bad when pitching. Even if someone didn't do their homework, etc. It might make you not want to work with the firm, but making someone look dumb will be a purely pyrrhic victory.

246/365: when you are bootpacking up it's easiest to look at the next step. Then the next. Then the next. Not more. If you look all around you're apt to feel that vertigo (and realize just how far it would be to fall )

247/365: preparation, planning, clarity, and then unrelenting execution.

248/365: following up on yesterday... Le frémissement de la vénerie, devancé seulement par la saveur de la victoire. When a friend helps you achieve something, it is even sweeter. A genuine thanks to friends who make a win all the more worthwhile.

249/365: there is a time to be right and a time to be wrong. A time to brag and a time to be modest. Being in any one camp too much ends up switching you to the other side.

250/365: on those rare days of unrelenting joy, yield to the flow. Allow the waves of goodness to wash over you, bobbing along a golden ocean of peace and mirth.

251/365: caring for employees in tail risk situations, often, but not always with insurance, is beyond a typical business environment. It's the right thing to do.

252/365: the least active person on socials in my friend group is probably the most successful. (But I don't totally buy it's causative.)

253/365: all VCs need an arcane VC knowledge buddy. This is the fund manager you call for the strange rare thing you did one time 10 years ago.

254/365: wit visits substance's estate, but alone, seldom inherits it.

255/365: sometimes you just need an old-fashioned truth-teller.

256/365: our time is limited, our breaths few, each moment in passing, towards focus anew.

257/365: "Let em breathe the flame, but show you how"

258/365: an easy way to spend a ton of unnecessary money is not preparing for a call with lawyers. Have everything sorted before the call and stick to the plan!

259/365: there are some problems that must be resolved indirectly.

260/365: on following up or reactivating VCs - remind them (1) when you last talked (2) what the company is doing (3) very concrete things that have happened (4) why you're reaching out now 4 concise lines, maybe several times

261/365: (related to yesterday) the tough thing about a VC reaching out again after a pass is that it could mean many things, but it rarely means "I want to write a check immediately".

262/365: I've found that "talkers", even if also decent listeners, often will misattribute or misremember good points that quieter colleagues have. (Sometimes even as their own ideas ) Very gently reinforce attribution, especially for junior team members.

263/365: change the venue if you can’t win on a certain battlefield against your opponent.

264/365: I'm not sure about private credit.

265/365: quality versus quantity.

266/365: rules for spousal co-founders: 1. Talk to 6 other co-founder couples: 3 with relationships still in tack and 3 that blew up 2. Speak for yourself, not as a unit in a all matters 3. Pay 4x as much attention to making fair and justified management decisions 4. Make sure your investors know you are in a relationship before they invest

267/365: Merry Christmas

268/365: you can stall at very high levels of revenue before liquidity; it's still a problem.

269/365: if you believe people are better than they are, sometimes it turns out to be the case.

270/365: don't seek to build a legacy.

271/365: "Changing the weather, by chop of the Cessna propellers"

272/365: the very toughest feedback is hard to listen to and believe (especially in today's world where so much is only positive.)

273/365:

Reflections of a curmudgeonly social media user in 2023

As the year comes to a close, I have been more active on social media than at any other point in my life. (Not counting things like IRC back in the day which was very different.)

Some of this was intentional – posting my “subsights” on the mundane and trite in VC without slipping into lazy cynicism or outright meanness (which I’m sure would have been more popular.)

And some of it was unintentional - I ended up meeting many interesting people and came to find joy in talking with, and following, them throughout the year. In finding this satisfaction I wanted to share some of my reflections on the social media format as a whole, and talk about the despicable and redeeming features of platforms like X.

The Despicable:

1. Social media consumption primarily celebrates vanity. Each time we log in we are stepping on to the hedonic treadmill of looking into the false, and better, versions of others' lives.

2. Creating stuff on social media is usually even more vain – “how many likes can I get? How many new followers? Etc.” It’s rarely for a more noble purpose (for any social platform to work this is how it has to be I suppose.)

3. Social media content is usually low-value and incredibly superficial - it’s a feature of the format, but it can easily give you a false perception of expertise.

4. It feels bad to have few followers, especially if you want more. However; most accounts with tons of followers are due to the age of the account, doing something interesting in real life, or making “posting” their full-time gig.

4a. Furthermore, most business topics (VC included) are pretty well covered. There’s not a lot of white space if you are coming into these topics without a huge audience.

5. Follower count gives legitimacy on the platform, but because of the above motivations it’s often an incredibly low-value signal. Furthermore, once someone has enough followers they can post about virtually any garbage and get engagement.

The Redeeming:

1. You don’t need a huge audience or pitch-perfect content to gain FRIENDSHIPS, and for this, especially in niche topics, social media can be incredible.

2. Social media has been an invaluable way to meet new people for my favorite hobby that would have taken decades to make in real life.

3. The friends and acquaintances (almost all experts) I have met in the Old Masters field have profoundly expanded my knowledge.

4. Even though my VC Subsights are not popular and have not given me new followers, they are moderately useful for some founders (either as light tips or for background when I chat with them).

5. At first, posting publicly with virtually no one listening feels like screaming into the void, but I’ve now realized it’s incredibly affirming and helps build conviction in your beliefs. After all, there is always the chance that someone reads what you wrote, and it’s fun to have the clarity of an idea written down. So my summary is: don't believe a popular post is actually correct, don’t sweat popularity, find new friends and social media can be awesome. To a healthy and productive 2024

274/365: in my mind there are two categories of habits: aspirational and functional. Aspirational habits are the ones you set in January - to be more fit, eat better, etc. It would be good if they happen, but they're tough to make stick. Functional are habits you should develop any time of the year, and rely on as your bedrocks as engagement in the world. You only need a few of these to be really life-changing. (For me it's regular exercise. Unless I am very sick I run every other day as a functional habit.)

275/365: last night my family came the closest to being shot that I’ve ever experienced. Driving home we inadvertently entered a gunfight where a guy was getting shot at by an automatic from an alley. I had to swerve to miss him as he ran away holding his handgun. Wild expression on his face, a painter could do it justice. Think Adriaen Brouwer, but devoid of any humor. Miracle the car, and family, wasn’t hit in the crossfire. I think the message is bad luck, good fortune, but just as easily can be bad luck and bad fortune.

276/365: as an analyst/associate at a VC firm you should optimize getting as many reps as possible for all types of situations. The second time you see something is infinitely easier than the first.

278/365: don't let judgement cloud understanding.

279/365: years ago @phalcehoods told me a story about an ancient general (not Lucullus?) Join me for a Sunday story : There was a general from antiquity who fought but a few battles yet was victorious in virtually all of them. This general, Lucullus, was lauded for his brilliance and circumspection and only moderately begrudged by his men who would have liked more treasure. As is sometimes the case, after this meretricious service he became a praetor.

He retired from a life in the field; of long nights, of blood, of winds whispering horses manes onward to battle in a rising wave of hooves and men ever closer to meeting to crash to the simple routines of the city. And it was entirely unexpected that this simplicity, the tameness, that came to form his everyday life, and so things were the same for many years. One night; however, Mars came to Lucullus in a dream. Wordlessly he took the general through time to each battle. Looking out upon the field Mars gripped the general's shoulder, and his men fell, nothing more than bones and cloth.

At each battle the general asked Mars "why do you turn my victories into ash?" But he received no answer. Finally the general and Mars arrived at his very first battle. And here, Mars spoke Though you had won many a battle over the years, they have flown into the memories of men who will soon forget them themselves. Your feats are behind Lucullus; yield to the days you have left in peace. The general awoke in a cold sweat. He sat and looked out across the fields to the sea and the rising sun, burning viciously behind the swaying wheat.

Bile and rage filled his throat. He could not yield to peace if the memories of his past victories were erased. Indeed, he was a general first of virtuous victories. Though he no longer commanded troops, Lucullus sought to take up the mantle again and was reluctantly given command of a force. Lucullus would bring his troops to the cusp of imminent victory. At that very moment, he would pull back, confident in victory and untouchable by Mars. No God nor man could take a victory that was not a victory. And so his caravan departed. For days they marched with vigor and with each step Lucullus' vigor and certainty increased. Far from losing the feel for battle, he instinctually felt it return in a quiet confident way. At night they came upon the town that they were to take: truth be told it was lovelier than other conquests over the year: small, yes, but put together and rich.

Mirth spilled from the flickering taverns and he could hear the cheers and shouts as the people below had one last drink before tomorrow's battle. As Lucullus was about to enter his tent a sallow, thin-faced leper grabbed his tunic, and in a voice that seemed much too loud for a sick man boomed "here walks Lucullus, a judge to the common man, a husband of many children." Incensed, Lucullus kicked him and said "and what else filth? Speak and I will let you live." But the leper just laughed and would say no more.

"Execute him on the spot and move my tent to a more favorable location." And so it was done. In a troubled state of mind Lucullus now looked at this city once more and smiled as he thought to himself "even if the leper is correct, this lovely town could have been mine, although I will not raze it. Only show my men and myself we are assured victory." And so they went to battle the next morning, but before the attack was seriously underway, another legion cut Lucullus' forces off.

These men were clumsy, haggard, and unskilled, but their position left Lucullus no opportunity to execute his plans. In time, this legion won a proper victory, while Lucullus could only stand among the hills. As he turned to return to his men, they knew him no longer. And then as Lucellus was suddenly turning, Mars reappeared before him. After a moment of apprising Lucellus, Mars with great force, tore a chunk of flesh from Lucellus' breast. He was no stranger to pain, but at thisLucellus to drop to his knees. As his blood pooled below him, he wheezed, "What have I done to dismay you? You have taken everything from me, though I was a most loyal warrior, why has this fate befallen me?"

In perfect coldness Mars responded: Your hubris has led you to ruin through pride and vanity. No man may change the course of time, and no man should seek false victories. The town that you lusted after, it's comely gardens, the narrow pathway, shall never be yours. You should have attacked or retreated, not engaged in folly. And look your men, they too are now but a mirage of your vanity. They know not of your great victories of the past. They want you not.

And with that Mars disappeared. Lucellus struggled to his feet, hand over right breast as the Mars had not the courtesy to take his left and kill him, and began to walk. (At least that's how I remembered it!)

280/365: the failure of an unjust pursuit is a victory. Don't contort your business.

281/365: "The problem of leisure

What to do for pleasure

Ideal love, a new purchase

A market of the senses

Dream of the perfect life

Economic circumstances"

Gang of Four wrote this in an anti-capitalist vein, but it holds significant meaning more broadly: You (as a founder) MUST work on something meaningful that gives you purpose. Your perfect post-exit life is a mirage. I've met many wealthy people over the years; the ones with purpose rather than unending leisure were always more content. And it's very rare that if leisure is your primary goal, you will make it anyway.

282/365: a simple rubric for the costs of implementation and customization with enterprise sales: keep it at 1/10th of ACV. It's not achievable in the early days, but if you start to think about it that way, the contribution margin should be >90% eventually.

283/365: don't use stock photos in the deck.

284/365: "protector in the light and a stranger in the dark"

285/365: the VCs can't save you, not really.

286/365: when the phase 2 fails you'll remember that the narrative doesn't exist outside of the broader universe of probabilities. Then realize the risk adjusted returns are in the consultants who will recut the data for the pay-to-play round.

287/365: it is better to act with humility, not because it is always warranted, but because when it is the downsides are enormous to be in the wrong.

288/365: every company has a BS container/fixer. Incredibly hard position to recognize and retain (as they usually just put out the small fires everywhere), but integral to success.

289/365: when you cut snow from the roof the shapes fall, consequentially if you're not careful, but only to return to water and start again.

290/365: it's hard to be truly excellent in multiple fields. If one feels good, it's important to grab it and go as deep as possible.

291/365: there’s an old school confidence that radiates kindness. See it in older people very comfortable with life.

292/365: For the average person routines can be incredibly powerful because they enable good consistency of output and give sense of agency. For people building or creating things I agree it's a silly notion, you should be doing THE thing as much as possible. https://x.com/nikitabier/status/1748867191762821337

293/365: the problem with "life" experience is that if you are too broad early on (partying too hard etc.) your trajectory is often stunted, but if you wait until you're older it's just as easy to go awry. Some sad cases on Twitter of the latter.

294/365: easy to get dispirited when running into fundraising adversity, but there's little upside to bringing that energy to new discussions.

295/365: duty then leisure.

296/365: if you clean up as many emails as possible in a set time it sometimes feels really freeing.

297/365: I'll always go to bat for our @CharacterVC founders. Hard to overstate the loyalty I feel to the founders that decide to work with us.

298/365: seeing a decent uptick in deals getting done over the past two weeks. Things definitely opening up. (Primarily new companies)

299/365: the first question to ask yourself is always “is this true?” Shockingly easy to forget at times.

300/365: Character Labs is BACK! https://character.vc/labs What: four-week sprint program for AI founders. Rapidly accelerate PMF through sequence of back-to-back sprints to validate product and GTM hypotheses.

301/365: pretty huge news, @jakek is full time with @CharacterVC!!! Hard to explain how amazing Jake is until you've worked with him... His amazing writing doesn't even do it justice. So if you're working on something sweet let us know!

https://x.com/jakek/status/1752437424305877149

302/365: this Airbnb book shelf is missing one key volume...

303/365: I'm tired.

304/365: winner's curse is such a real thing. This is why valuation discipline is especially important if you are leading.

305/365: you don't surf.

306/365: when you have terrible customer experience it's best to channel that frustration into a doc. Something like "things that suck when a company does that." Then fight against those failure modes in your own company.

307/365: “A man of genius makes no mistakes. His errors are volitional and are the portals of discovery”.

308/365: never an ugly child, or a creation that you can look upon with total objectivity.

309/365: I wish there was an easier way on Zoom to explain to people I am not normally a mouth breather; my nose is just stuffed. With no explanation, this is my default look:

310/365: I am not a fan of audit work.

311/365: cultivating pipeline is an active rather than passive exercise. Otherwise weeds growing in the garden can seem like a positive KPI.

312/365: Saturday mood in all but location . See you tomorrow

313/365: check my co-founders out here: https://x.com/jakek/status/1756748702444867713

314/365: the @bankofengland IPOed in 1694 and was anchored by William III & Mary II. It quickly hit its goal of raising £1.2M from 1,268 investors in 11 days. At the time it had an 8% coupon, not bad! It was nationalized in 1946.

315/365: the piano moving business is great until you drop your first piano.

316/365: the MOST misunderstood lesson from Warren Buffett is that there is some secret he holds and you as an acolyte must read enough anecdotes about him to learn it. Lock yourself in a room and only read 10-Ks for 50 years. That's the secret.

317/365: it's important to think about the timeline in which you report because it guides how your team thinks about the world. Month over month versus quarter over quarter can be a more nuanced decision than you'd expect.

318/365: using my non-existent audience for a very important FYI: If you are in Wisconsin and a doctor totally botches something, or say kills your kid, there is no economic recourse. Rest in peace Amillianna Ramirez-Johnson.

319/365: the vast majority of alpha in investing was never written about.

320/365: "science annihilates distance."

321/365: the inherent tension in diligence is streamlining the process to be efficient, yet staying flexible enough to catch crucial insights that only a deep dive can reveal.

322/365: the confidence level of a consultant typing only with his pointer fingers while encroaching on his seat mates.

323/365: we all know the adage "hire a person you want to get a beer with", but it's also important to calibrate the speed of the team you're working with.

324/365: in valuable organizations a consolidation of power will naturally occur - the legitimacy of which you will firstly judge by your compensation and secondly the manner in which it was determined.

325/365: a surprisingly risky combo is being incredibly smart and incredibly impressionable (less common in founders than the broader tech ecosystem IMO.)

326/365: when pitching yourself it's helpful to be concise and direct: "here is why what I did in the past is important: [x], here is why what I am doing now logically follows: [y], here is why, with proof, you should believe I'm exceptional [z]"

327/365: Carole and the End of the World is a very interesting show that gave me new insight into the meaning of work.

328/365: some founders…Sumner Redstone:

329/365: obsession can’t be faked in the long term which makes it so hard to beat.

330/365: half of the game is staying one drink behind the other person.

331/365: "nomen est omen" The name is the omen (your name predicts your future.) Always hated this as a bastard. Less about the read on destiny but more about the assumptions people make about your name. All words are potential false credentials look to results.

332/365: Truckin', got my chips cashed in

Keep truckin', like the do-dah man

Together, more or less in line

Just keep truckin' on

333/365: being right isn’t always the same as winning.

334/365: it only takes one bad member to spoil everything.

335/365: setting reasonable expectations for LPs is critical because they won’t all understand seed as an asset class (particularly around liquidity timing.)

336/365: it is possible to be friend zoned as a founder (although rare.)

337/365: most people have a tiredness-level threshold that inevitably leads to mistakes. Key to recognize in yourself. (Yes I hit it.)

338/365: what is the timeframe for antitrust action? Is the notion that most monopolies continue forever without intervention?

339/365: even workshop can be excellent.

340/365: "I say the right thing, but act the wrong way

I like it right here, but I cannot stay

I watch the TV, forget what I'm told

Well, I am too young and they are too old

The joke is on you, this place is a zoo"

341/365: I've been thinking about the friends I've met over the past few years, and it's almost unimaginable to remember my life when they weren't in it. Random reader, I wish the same for you - to find friends who are like minded, but true, and fair, and funny.

342/365: I've met few to no entrepreneurs that did it for the money and made the money (as a first and foremost goal.)

343/365: nothing real is perfect. For example: the plants at the restaurant must have imperfections otherwise you know they're plastic.

344/365: don't feel bad not being sold a product at a certain level - for example luxury buyers are sometimes fawned over, which may or may not be a good thing for you.

345/365: sometimes the thing you hate you spend a ton of time on, then you end up becoming good at it, and spending more time on it. The hate-it competence loop

346/365: for first time founders a huge task is selecting the right information to follow. Repeatability and outcomes are good signals.

347/365: among the many things that make @pmarca exceptional, don’t forget how long he’s been in the game…from Vanity Fair in 1995:

“Clark, aged 51, and his partner, 24-year-old Marc Andreessen, have developed not just the grail-like "killer application" but also the standard—the platform—for the information superhighway. … In just 12 hours in a suite at the University Inn, Clark and Andreessen managed to raid the best and brightest Mosaic creators from the University of Illinois's National Center for Supercomputing Applications.”

348/365: slipped back into old old substandard habits today. Wild how they reappear and then you have to fight them off again even when you thought they were long vanquished.

349/365: if it doesn't serve you, and it's only something you can see, why not let it go?

350/365: the value of any given piece of your startup if so dependent on perception rather than truth the closer you are to founding. Can leave a sour taste in your mouth if you think the world will objectively view your work.

351/365: in virtually every domain I'm familiar with this is the case:

352/365: excessive charisma can mask lack of talent.

353/365: asking for excessive terms at the last minute is bad practice.

354/365: tomorrow is the first day of our next @CharacterVC Labs! The teams are absolutely incredible. Full stop.

355/365: pride can be an enemy of knowledge.

356/365: you haven't followed many people in the last year that were good, or kind, or slow, or advocates of morality. Instead we follow outrage, strife, quick get-rich schemes, and desire. If you're creating something new be careful about this mental pollution.

357/365: we just wrapped the first few days of @CharacterVC Labs, always a joy to see how super technical founders find Sprint so useful (sometimes they start slightly skeptical.)

358/365: the best way to deal with a pass is to just get back to building.

359/365: it's true that being hyper responsive in the fund raising process is always a positive signal.

360/365: if you don't have a tiny bit of fear in the big round that you passed on you're probably missing something.

361/365: after all these years I still get such a thrill from meeting those rare super exceptional founders.

362/365: very grateful to the @ycombinator team for inviting me at the reception tonight, and in particular to @garrytan, for all he's doing to help grow YC for the future. Only downside was not seeing @paulg to nerd out on Old Masters...another time

363/365: waiting to hit metrics to invest is so boring.

364/365: hedging against catastrophe with gold or something is dumb because there is no clear cutoff for the end of the world. War, pestilence, and poverty are par for the course for most of humanity through the ages. Better to hedge with skills.

365/365: it wasn't worth it. Done with subsights with a longer post on my thoughts to come .

Started on March 23, 2023

Completed on April 6, 2024